Combining to Serve You Better

Wakefield Cooperative Bank is joining forces

with Reading Cooperative Bank.

LATEST UPDATES

Expanded ATM Network Available

We're pleased to announce that all Wakefield Cooperative Bank ATMs have been added to our network....

Expanded ATM Network Available

We're pleased to announce that all Wakefield Cooperative Bank ATMs have been added to our network....

Expanded ATM Network Available

We're pleased to announce that all Wakefield Cooperative Bank ATMs have been added to our network....

Full Transition Completes on August 4

The transition of accounts from Wakefield to Reading Cooperative Bank will take place over the weekend of August 1, 2025 and be officially completed on Monday, August 4, 2025. At that time, with everything fully integrated, the merger between our two banks will be officially completed, and all banking will continue under the Reading Cooperative Bank institution.

KEY INFORMATION

-

The information provided about the transition applies to all previous Wakefield customers as we work to transition their accounts to join Reading Cooperative Bank's internal systems, along with the full transition of Wakefield's online banking and mobile banking platforms. Current RCB customers should not experience any changes to their banking experience.

-

Once the partnership is finalized, all accounts will be merged into RCB's internal systems, allowing customers full access to all products and services at any branch location.

All deposits will continue to be covered by the Federal Deposit Insurance Corporation (FDIC) and the Depositors Insurance Fund (DIF). Any customer balances above the FDIC limit are insured in full by the DIF. Since the DIF was established, no depositor has ever lost a penny at a Massachusetts savings or cooperative bank.

Here's what to expect with your existing accounts:

- Your existing account numbers will remain the same.

- Certificates of Deposit (CDs) will remain unchanged.

- While Wakefield's routing number will remain valid indefinitely, update your direct deposit and electronic payments with the new routing number: 211372404 to ensure uninterrupted service.

- Individual Retirement Accounts (IRAs) will be transitioned to RCB with an annual fee of $10 charged in December. You can expect to receive your tax documents from RCB for the tax year ending December 31st, 2025. If you are aged 73 or older, you can take the remainder of your required minimum distribution at RCB. If you have not yet fulfilled your required minimum distribution of 2025, please call 781.942.5000

- Some account names will change to match with RCB's products. See this chart to understand the new names of your accounts.

Consumer Checking Accounts

This WCB product... becomes this RCB product Free Checking Value Checking Regular Now Checking Value Now Checking Advanced Premier Checking Value Now Checking Savings & Money Market Accounts

This WCB product... becomes this RCB product Money Market Money Market Deposit Account Ultra Money Market Money Market Deposit Account Platinum MMDA Money Market Deposit Account IRA Passbook Savings IRA Statement Savings Business Checking Accounts

This WCB product... becomes this RCB product IOLTA IOLTA Checking Small Business Checking Easy Business Checking Commercial Checking Enterprise Checking The following account names will not change:

- Premier Rewards Checking

- Premier Checking

- Freedom Checking

- Premier Cash Back Checking

- Ultimate Plus MMDA

- All Time Deposit Product

-

To continue using the following services, you will need to take some additional steps.

- Your new contactless RCB debit card will arrive during the third week of July with activation instructions. You can begin using it on August 1st after 6 PM. You will need to re-establish any card limits, alerts, and blocks within the RCB online and mobile banking menu after August 4th.

- Mobile banking must be done through the Reading Cooperative Bank mobile app after August 4th. For a smooth transition, remove the WCB app from your device and download the RCB app to use instead.

- Checks will continue to be usable, and when you reorder you will receive RCB checks.

- All Quicken and QuickBooks users must deactivate their Wakefield accounts before 5 PM on August 1st and reactivate them with RCB starting August 4th at 9 AM. Be sure to back up your data prior to transitioning.

Note that the following services will no longer be available through RCB:

- Privilege Overdraft Protection will no longer be available effective July 31.

- Zelle will be permanently deactivated starting at 9 AM on Friday, August 1. At RCB we use a person-to-person (P2P) payment method that allows you to pay using your account or Venmo. Learn more at readingcoop.com/p2p

-

RCB's Online Banking will be available starting August 4th at 9 AM. Users can can log in with their existing online banking credentials.

Mobile Banking users will need to delete the Wakefield Cooperative Bank app from their device and download the Reading Cooperative Bank Mobile App to continue using mobile services.

Online Bill Pay will be temporarily unavailable for Wakefield customers starting Friday, August 1 at 9 AM and will be available again on Monday, August 4th at 9 AM. Login information will remain unchanged.

Telephone Banking will become unavailable to Wakefield customers starting at 5 PM on Friday, August 1. After August 4th, dial 888.469.4441 for RCB's Telephone Banking. Your temporary PIN will be the last four digits of your Social Security number or Tax ID. For businesses, your temporary PIN will be the last five digits of your Social Security Number. 12 months of transaction history will be available within telephone banking.

-

Your final bank statement from WCB will be issued on August 1st for all activity through that date. Going forward, all monthly statements will be generated on the last business day of the month and will come from RCB. If you are enrolled in e-statements, you will continue to receive email notifications featuring the RCB name when your e-statement is ready. You will have access to 16 months of WCB statements in online banking.

At the end of the year, customers will receive a single tax document for the 2025 tax year from RCB for all qualifying activity.

-

While Wakefield's routing number will remain valid indefinitely, update your direct deposit and electronic payments with the new routing number: 211372404 to ensure uninterrupted service.

Starting August 4th, if you intend to bank by mail, please send any deposits or transactions to Reading Cooperative Bank, P.O. Box 330, Reading, MA 01867

For mortgage, Commercial Loan, and Line of Credit Customers, you can still drop off payments at any location, though we recommend you update the mailing address to Reading Cooperative Bank, 180 Haven Street, Reading, MA 01867. Your loan number, terms and conditions will all remain unchanged.

-

Your Online Bill Pay service will temporarily be unavailable starting Friday, August 1st at 9 AM and will become available on Monday, August 4th at 9 AM. Otherwise, your service will continue uninterrupted, including payees, recurring payments, and future-dated payments.

Your Online Banking login information will not change. However, business admins will no longer be able to add users. Please contact Jessica Glezellis, VP, Cash Management Officer, at 781.670.1530 or jglezellis@readingcoop.com, and we will add users for you.

If your account is an IOLTA account, it will transition to an IOLTA account at RCB.

Credit Cards will remain unchanged.

RCB also offers the following additional services to business customers. Learn more about RCB's business services.

- Positive Pay

- Lockbox Services

- Payroll and HR Services

- Business Checks

- Merchant Services

- Online Wire Transfers

-

RCB may utilize different ATM networks than WCB. We offer access to over a dozen RCB ATM locations conveniently situated near where you live, work, and play and offer accounts with ATM fee rebates. If you have concerns about ATM availability, please contact a Banking Specialist. Learn where our ATMs are located by visiting readingcoop.com/locations.

-

THIRD WEEK OF JULY

RCB Debit Cards Arrive by Mail

Activate your card as soon as it comes in the mail using the instructions included. You can begin using your card on August 1 after 6PM.

-

FRIDAY, AUG 1

Merger Begins

All in-branch banking activities will be available during normal business hours.

Scheduled Changes:

9 AM: WCB Bill Payment will be down, but scheduled payments will continue without interruption. Zelle will be permanently deactivated.5 PM: Online Banking and Telephone Banking will become unavailable.

6 PM: New debit cards become usable for all customers

-

SATURDAY, AUG 2 – SUNDAY, AUG 3

Merger Continues

The Lynnfield, Melrose, and Wakefield locations will be closed on Saturday, August 2nd. All other locations will be open during regular business hours (9 AM to 12 PM).

Extended live telephone and email support hours will be offered over the transition weekend:

• Saturday, August 2nd: 9 AM - 5 PM

• Sunday, August 3rd: 9 AM - 2 PMScheduled Changes:

• ATMs will be limited to withdrawals only. The daily withdrawal limit will permanently increase to a $1,000.• Debit card purchases will increase to a $3,000 daily limit.

-

MONDAY, AUG 4

Merger Complete

All RCB banking services will be available by 9 AM.

Scheduled Changes:

• Any banking done by telephone, by mail, online, or on mobile must now be done through RCB.• Debit card limits, alerts and security features can now be updated through RCB's online and mobile banking platforms.

• Online Bill Pay becomes available again to all customers.

Shared Vision, Shared Values

Built on the same beliefs, structure, and even the same internal technology, our two organizations can start working together faster while delivering a smooth transition for our customers. And with so much in common, Reading and Wakefield Cooperative Banks are a natural fit.

Cooperative Mission

As customer-owned banks, our structure, mission, and outlook are inherently aligned.

Growing Together

Our banks' mutual goals focus on expanding our services to continuously meet customer needs.

Community Partners

Through our expanded branch network, we can strengthen our commitment to the North Shore community.

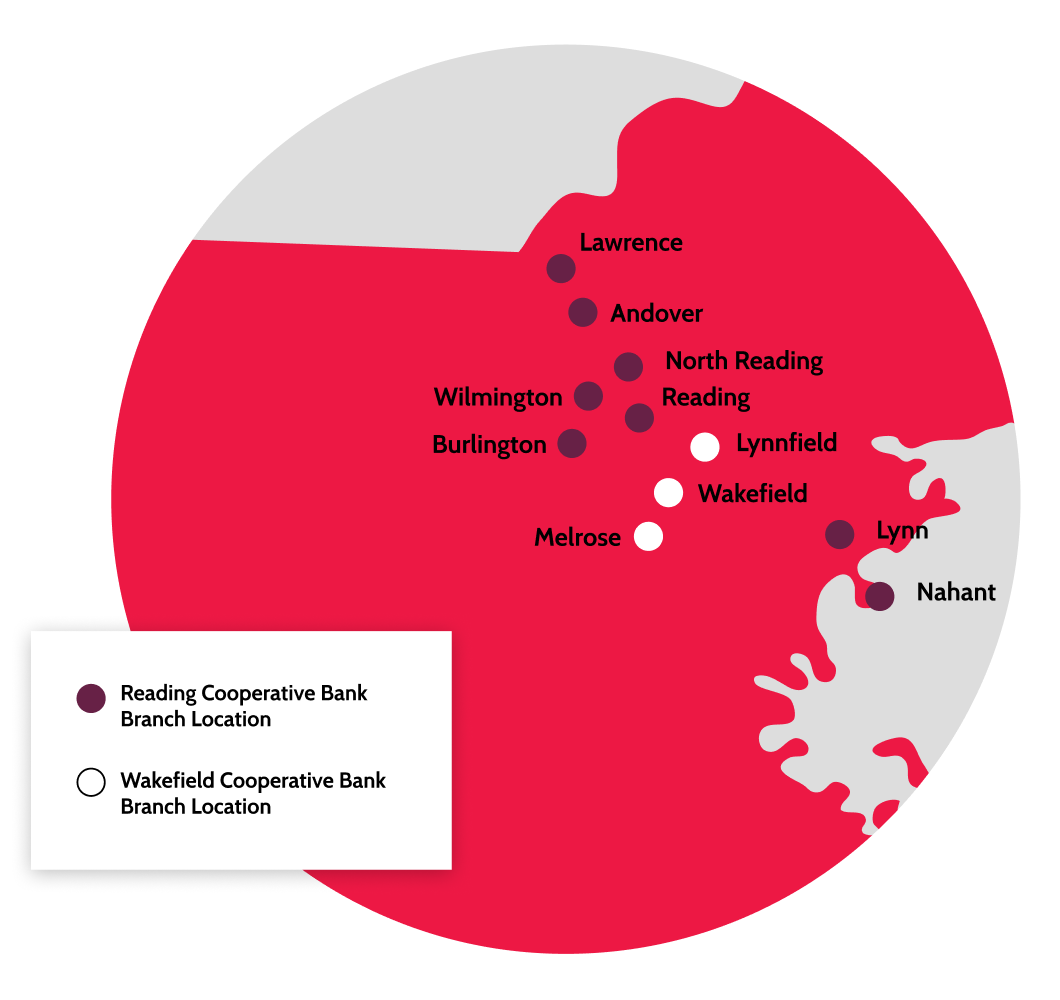

OUR EXPANDED NETWORK

Reading Cooperative Bank and Wakefield Cooperative Bank are combining to better serve you.

Under the Reading Cooperative Bank name, Reading Cooperative Bank's current President and CEO Julieann M. Thurlow will lead the organization, with Wakefield Cooperative Bank President and CEO Jeffrey A. Worth joining as President.

WATCH THE PODCAST

Frequently Asked Questions

-

Current RCB customers will not experience any changes to their accounts, but will soon gain access to all of Wakefield Cooperative Bank’s locations as a part of their banking experience.

-

As Wakefield Cooperative Bank makes the transition to join Reading Cooperative Bank’s internal systems, we are working to merge all existing Wakefield accounts into RCB’s systems along with the full transition of Wakefield's online banking and mobile banking platforms. Once this process is finalized, Wakefield customers will be notified about how they can access their RCB accounts and will gain access to all of RCB’s branch locations in addition to their current branches.

-

We can assure you that no branches will be closed as part of this merger. All existing branches will remain open, providing you with continued access to the services and staff you know and trust. While there is no current plan to change branch hours, we will certainly look at this as part of an effort to provide more efficient and convenient service to all customers at all of our combined locations.

-

Once the partnership is finalized, all accounts will be merged, allowing customers full access to all products and services at any branch location.

Here's what you need to know:

- Your existing account numbers will remain the same.

- Certificates of Deposit (CDs) will remain unchanged.

- Note that the following services will no longer be available through RCB:

- Privilege Overdraft Protection will no longer be available effective July 31.

- Instead of Zelle, we use a person-to-person (P2P) payment method that allows you to pay using your account or Venmo. Learn more at readingcoop.com/p2p

- Your new contactless RCB debit card will arrive during the third week of July with activation instructions. You can begin using it on August 1st after 6 PM. You will need to re-establish any card limits, alerts, and blocks within the RCB online and mobile banking menu after August 4th.

- You can continue using your existing checks; when you reorder, you will receive RCB checks.

- Starting August 4th, if you intend to bank by mail, please send any deposits or transactions to Reading Cooperative Bank, P.O. Box 330, Reading, MA 01867

- Withdraw funds at any RCB ATM without a fee starting May 1st. Deposits and balance checks at RCB ATMs will be available beginning in August.

- Your statements will continue as expected, but will feature Reading Cooperative Bank’s name and contact information.

- All Quicken and QuickBooks users must deactivate their Wakefield accounts before 5 PM on August 1st and reactivate them with RCB starting August 4th at 9 AM. Be sure to back up your data prior to transitioning.

- Individual Retirement Accounts (IRAs) will be transitioned to RCB with an annual fee of $10 charged in December. You can expect to receive your tax documents from RCB for the tax year ending Devember 31st, 2025. If you are aged 73 or older, you can take the remainder of your required minimum distribution at RCB. If you have not yet fulfilled your required minimum distribution of 2025, please call 781.942.5000

- For mortgage, Commercial Loan, and Line of Credit Customers, you can still drop off payments at any location, though we recommend you update the mailing address to Reading Cooperative Bank, 180 Haven Street, Reading, MA 01867. Your loan number, terms and conditions will all remain unchanged.

- Start banking at any of RCB’s nine branches; full integration of services will occur on August 4th.

- While Wakefield's routing number will remain valid indefinitely, update your direct deposit and electronic payments with the new routing number: 211372404 to ensure uninterrupted service.

All deposits will continue to be covered by the Federal Deposit Insurance Corporation (FDIC) and the Depositors Insurance Fund (DIF). Any customer balances above the FDIC limit are insured in full by the DIF. Since the DIF was established, no depositor has ever lost a penny at a Massachusetts savings or cooperative bank.

-

We are committed to job security and will make every effort to retain the majority of employees in their current or similar roles within the organization. Our staff’s expertise and familiarity with our customers are vital to our success. All Wakefield employees will be provided with the necessary training and resources to ensure a smooth transition and will receive every benefit available to current RCB employees.

-

This merger will create new opportunities for growth and advancement, allowing us to offer even more meaningful and innovative services to meet our customers’ needs. We aim to enhance our service offerings and provide customers with greater convenience, such as new financial products and more branch locations and ATMs!

-

Yes, with convenient mobile banking, you can access your accounts through our mobile banking app. RCB mobile banking has safe, easy-to-use features that let you manage your accounts and pay bills when you're banking on the move. (additional information can be found here).

-

Telephone Banking will become unavailable to Wakefield customers starting at 5 PM on Friday, August 1.

After August 4th, dial 888.469.4441 for RCB's Telephone Banking. Your temporary PIN will be the last four digits of your Social Security number or Tax ID. For businesses, your temporary PIN will be the last five digits ofyour Social Security Number. 12 months of transaction history will be available within telephone banking.

Wakefield customers can begin using RCB's Online Banking starting August 4th at 9 AM, and can log in with their existing online banking credentials. Mobile app users will need to delete the Wakefield Cooperative Bank app from their device and download the Reading Cooperative Bank Mobile App to continue using mobile services.

Online Bill Pay will be temporarily unavailable for Wakefield customers starting Friday, August 1 at 9 AM and will be available again on Monday, August 4th at 9 AM, and login information will remain unchanged.

-

Both banks have a long-standing commitment to cooperative values that have guided our missions for over 100 years. We are dedicated to creating an inclusive environment that honors our traditions while prioritizing the needs of our customers and communities. All current Board Members from both banks will continue to serve on the combined Board, enabling us to collaborate on our shared goals. This merger strengthens our community presence, allowing us to focus more effectively on our combined mission than we could individually.

-

The partnership is expected to be finalized by August 4th. In the days leading up to the final merger date, WCB customers will see some changes and interruptions to their banking services. See the timeline for more details.

-

If you have any questions about this transition, we're here to help! Please call Reading Cooperative Bank at 781.942.5000 or email us at banking@readingcoop.com during regular business hours (Monday - Friday 8 AM - 5 PM) and our Banking Specialists will guide you through this transition.

For immediate questions or concerns about the combination, please feel free to reach out via email to Julieann M. Thurlow at jthurlow@readingcoop.com or Jeffrey A. Worth at jworth@wcbbank.com.